A marketing wizard, all-in-one.

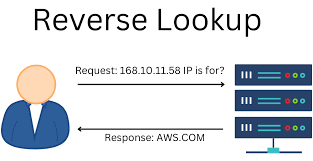

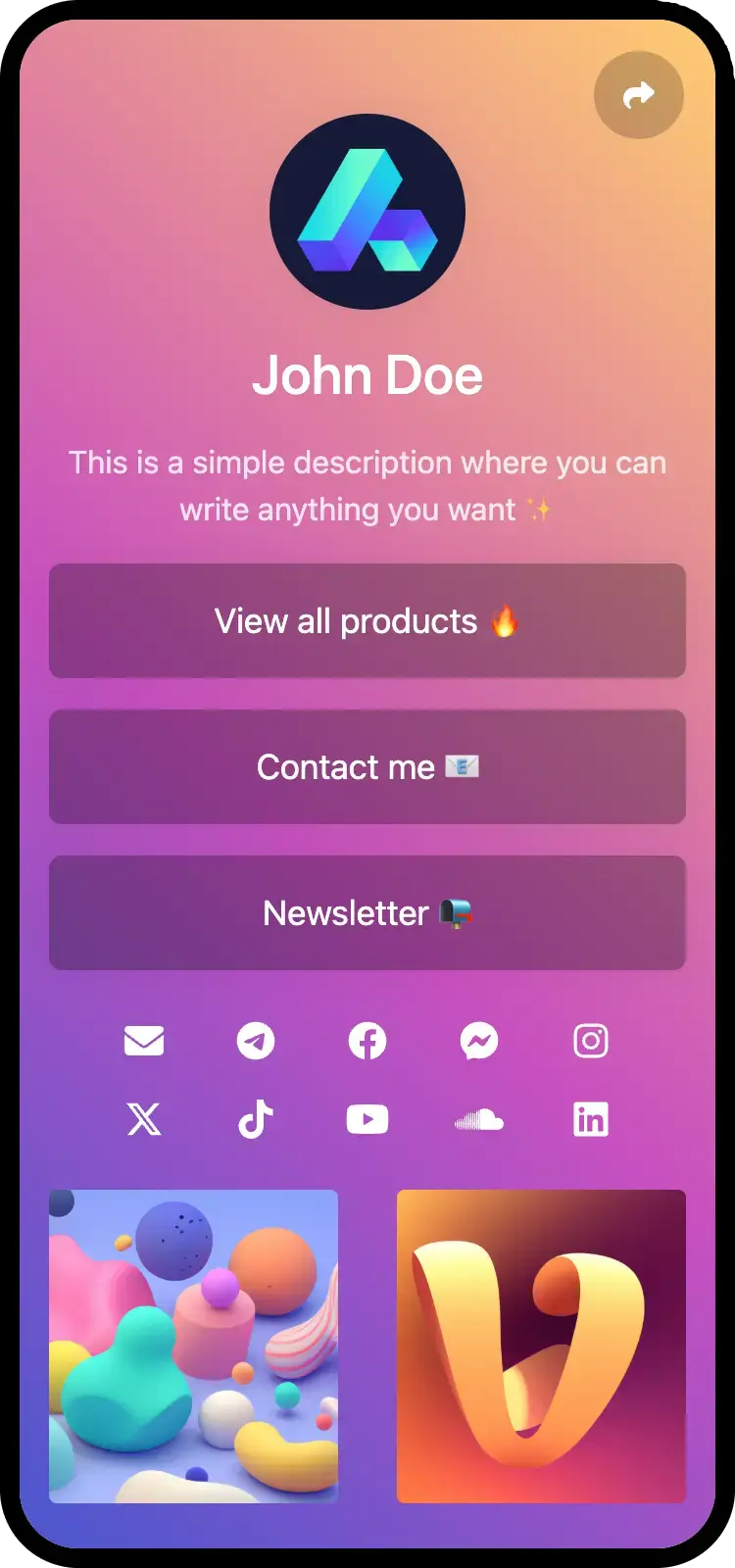

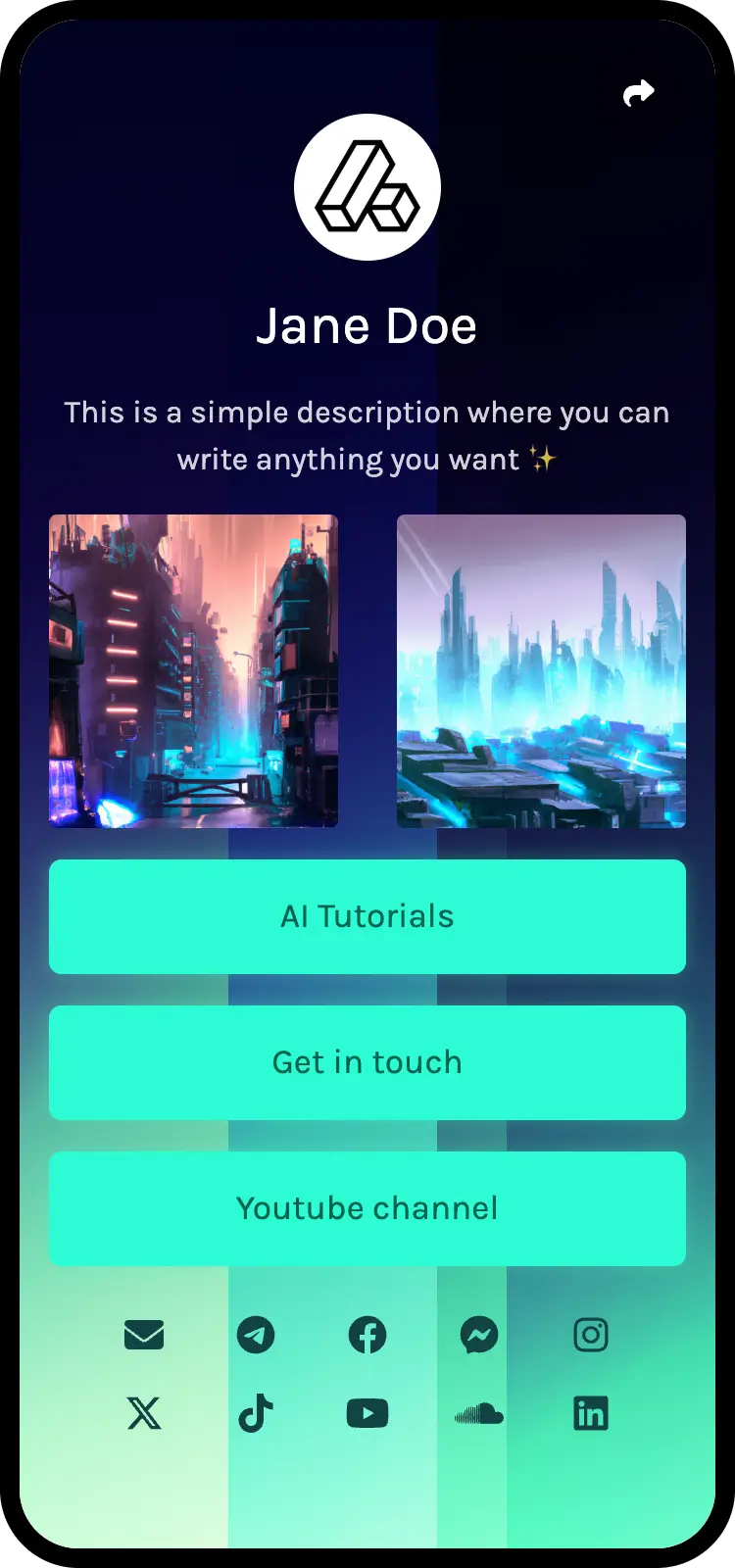

Bio link pages

Create your own unique & highly customizable bio link page with ease.

-

Custom colors & branding

-

Tons of ready-to-use components

-

SEO settings

-

Password protection, sensitive content warning

-

Countless pre-made templates & themes

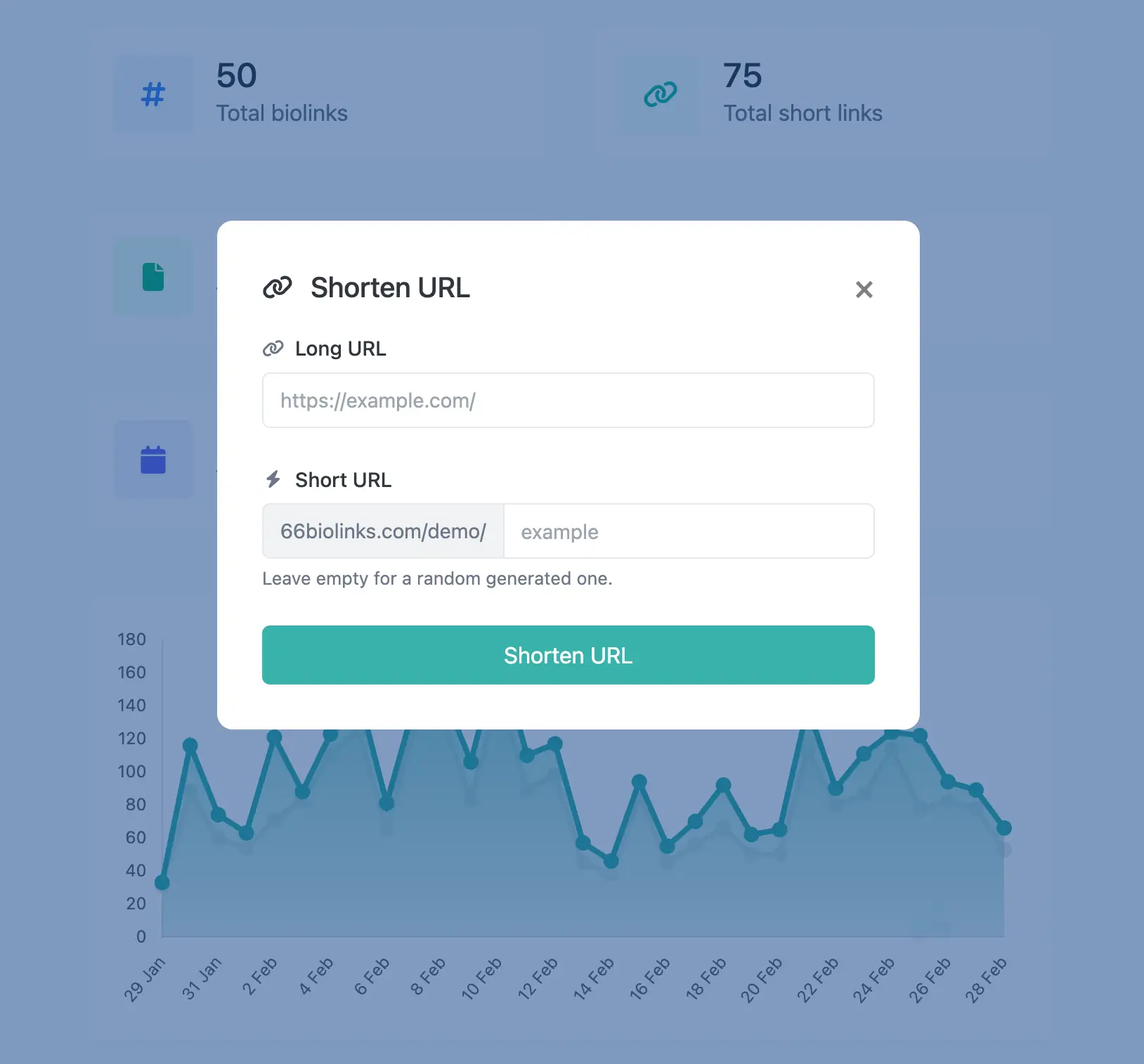

Shortened links

A state of the art URL shortener service.

-

Scheduling & expiration limits

-

Country, device & language targeting

-

A/B Rotation

-

Password protection, sensitive content warning

-

Deep links support for apps

-

Advanced URL cloaking

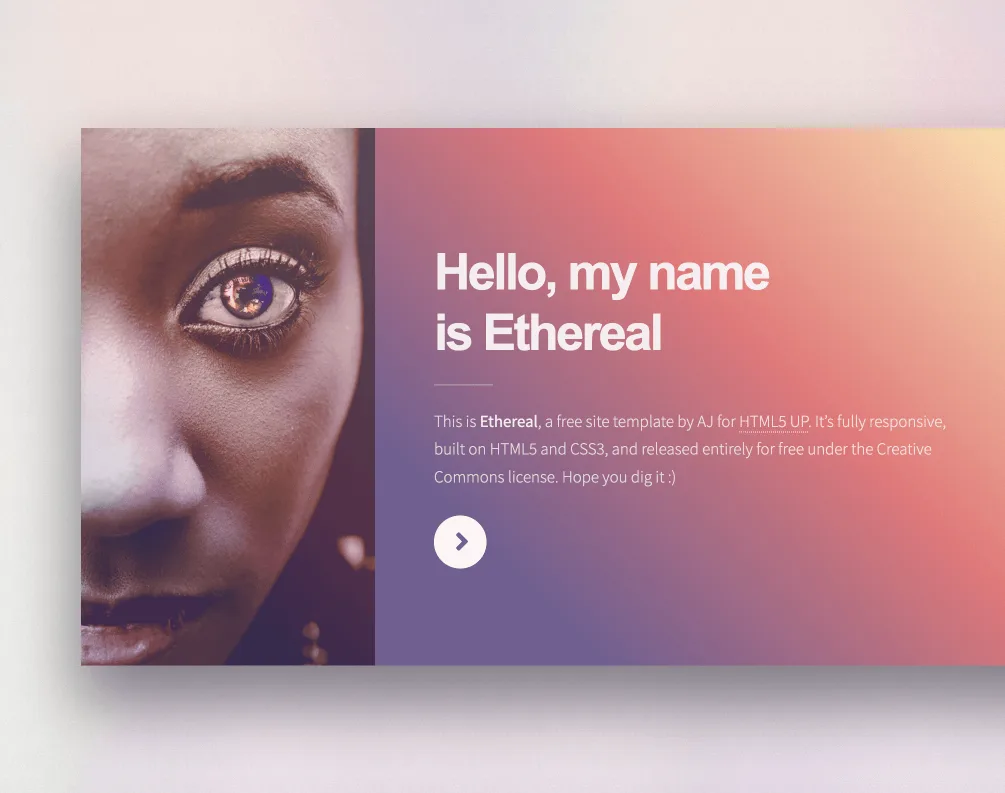

Host static sites

Upload your website files and we will host them for you.

-

HTML, CSS, JS, Video / Audio files.

-

Analytics, password protected

-

Automated tracking pixels

-

and much more...

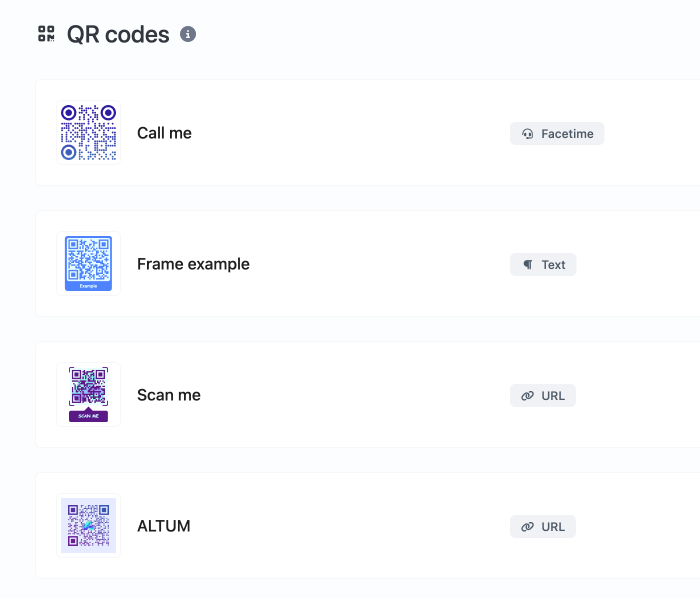

QR Codes

Fully featured QR code generator system with easy to use templates.

-

Custom colors with gradients

-

Custom logo & background branding

-

Multiple QR shapes to choose from

-

Customizable QR Code Frames

-

Vcard, WiFi, Calendar, Location..etc templates

Built-in analytics

Easy to understand, yet detailed analytics for all your links.

-

Continents, Countries & cities

-

Referrers & UTMs

-

Devices & operating systems

-

Browsers, Languages

-

GDPR, CCPA and PECR compliant

URLs that open apps automatically

Short links that automatically detect the used app and open it on mobile.

Tracking pixels

All the links easily integrate with any of the following pixel providers.

126 must-have tools

A collection of great checker-type tools to help you check & verify different types of things.

A collection of text content related tools to help you create, modify & improve text type of content.

A collection of tools that help you easily convert data.

A collection of the most useful generator tools that you can generate data with.

A collection of highly useful tools mainly for developers and not only.

A collection of tools that help modify & convert image files.

A collection of date & time conversion related tools.

A collection of other random, but great & useful tools.

Developer ready

Fully featured & easy to use API system for developers.

--url 'https://spfmyanmar.xyz/api/links' \

--header 'Authorization: Bearer {api_key}' \

--header 'Content-Type: multipart/form-data' \

--form 'url=example' \

--form 'location_url=https://spfmyanmar.xyz/' \

Why people love us

“ This platform completely transformed the way we manage our workflows. It’s intuitive, fast, and has saved our team countless hours every week. ”

“ I was skeptical at first, but within days, I saw how much more productive our team became. The support team is also incredibly responsive. ”

“ We’ve tried multiple tools before, but nothing comes close to this. The onboarding was smooth, and our entire team was up and running in no time. ”

Simple, transparent pricing.

Free

-

15 biolink pages

-

0 biolink blocks

-

20 biolink blocks

-

25 shortened links

-

0 bulk links

-

0 file links

-

0 vcard links

-

0 event links

-

0 static sites

-

0 QR codes

-

0 bulk QR codes Limit

-

0 splash pages

-

10 pixels

-

1 custom domains

-

0 days stats retention

-

0 additional domains

-

0 biolink themes

-

0 biolink templates

-

No forced splash page

-

Custom back-half

-

Deep linking

-

Removable branding

-

Custom branding

-

Dofollow links

-

Leap link

-

SEO features

-

Additional fonts

-

Custom CSS

-

Custom JS

-

Indepth statistics

-

Links scheduling & limiter

-

Cloaking short URLs

-

Auto open app on mobile

-

Advanced targeting

-

UTM parameters

-

Password protection

-

Sensitive content

-

No ads

-

API access

Answer for your common question

Get started

Start using the swiss army knife for the marketers.

Latest blog posts

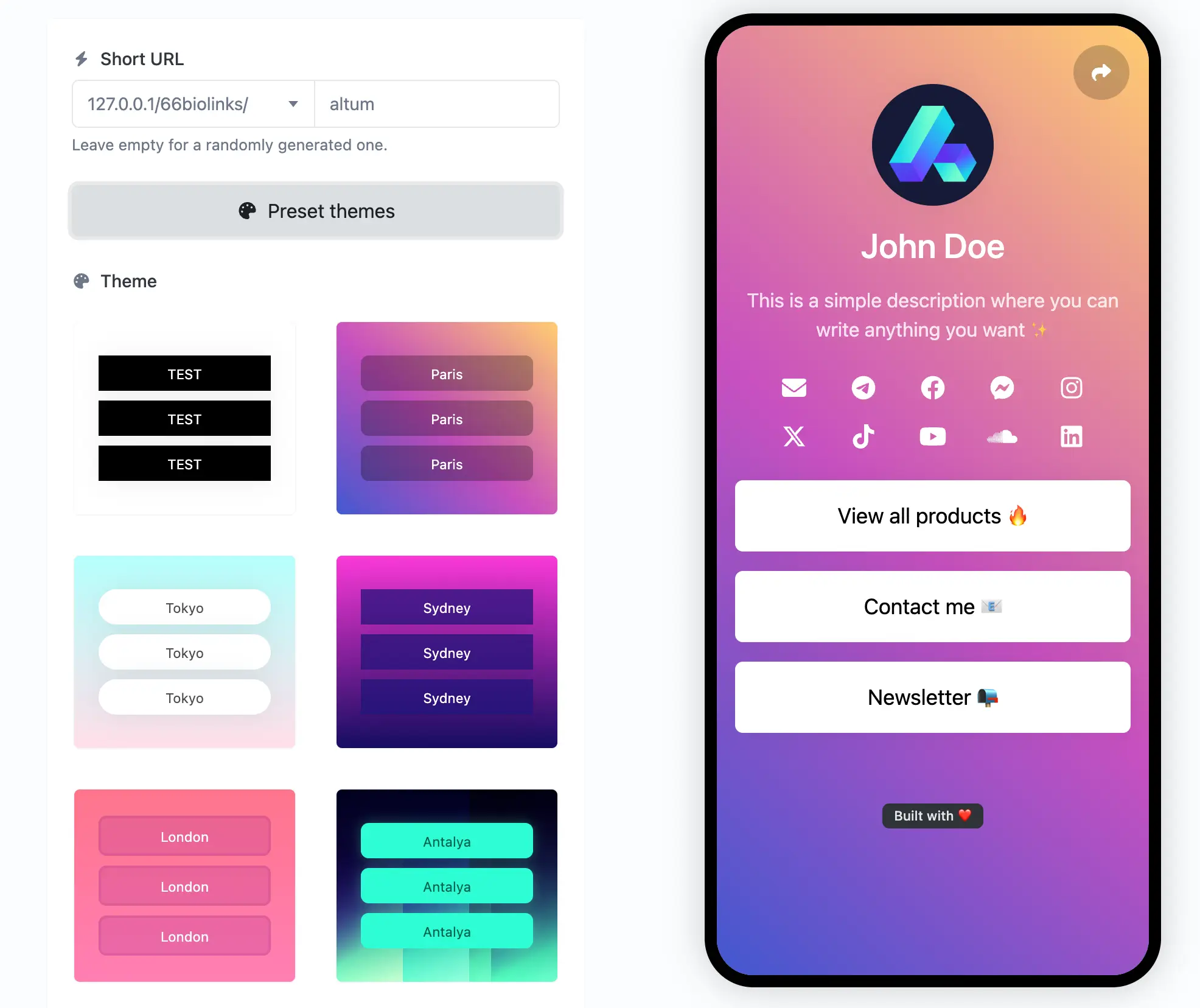

DNS Lookup: Your Ultimate Guide to Internet Navigation

DNS Lookup: Your Ultimate Guide to Internet Navigation