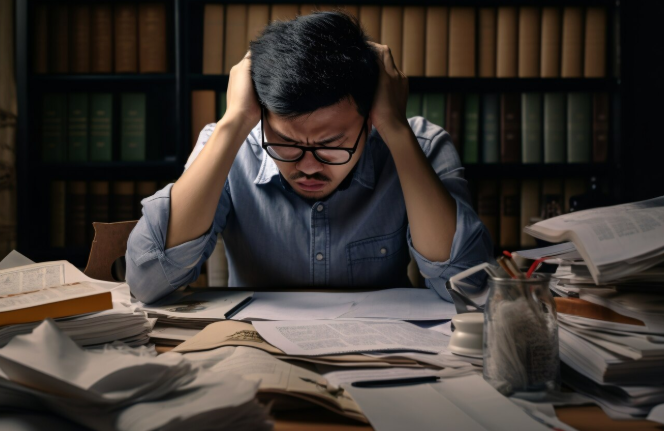

🟢 Introduction

Your 20s are for building memories — and building habits.

But one small money mistake now can cost you years down the road.

Here are 8 common financial mistakes to avoid in your 20s — and exactly how to fix them before it’s too late.

🔵 1. Living Beyond Your Means

Just because you can swipe it doesn’t mean you can afford it.

Spending more than you earn = long-term debt trap.

✅ Fix: Track your expenses and stick to a budget (use apps like Mint or YNAB).

🔵 2. Not Building Credit Early

No credit = no car, no apartment, and high loan interest later.

✅ Fix: Get a beginner-friendly credit card and pay it off in full each month.

🔵 3. Ignoring an Emergency Fund

Accidents, layoffs, or health issues don’t come with a warning.

✅ Fix: Start saving $10/week until you build up at least $500–$1,000.

🔵 4. Avoiding Investing Because “It’s Too Early”

The earlier you invest, the richer future-you becomes.

✅ Fix: Use apps like Acorns or Fidelity to invest small amounts monthly.

🔵 5. Not Tracking Subscriptions

Streaming, apps, and “free trials” pile up fast.

✅ Fix: Review your bank statements monthly and cancel unused services.

🔵 6. Taking On Student Loans Without a Plan

Debt without direction is dangerous.

✅ Fix: Know your future career earning potential before borrowing — and always have a repayment plan.

🔵 7. Not Learning About Money

Schools don’t teach it — but life demands it.

✅ Fix: Read personal finance books or follow trusted YouTube/Podcasts (like “The Budget Mom” or “Graham Stephan”).

🔵 8. Thinking Budgeting is Only for Poor People

Budgeting isn’t about being broke — it’s about being smart.

✅ Fix: Create a simple budget that aligns with your goals and values.

✅ Conclusion

Your 20s are a golden decade — don’t let money mistakes steal your future.

Fix one today, and you’ll thank yourself in your 30s (with interest).

Leave a Comment