🟢 Introduction

Life happens — and when it does, an emergency fund can save you from debt and stress. Whether it’s a medical bill, car repair, or sudden job loss, having cash set aside is the smartest financial move you can make. The best part? You can build one even if you’re broke. Here’s how.

🔵 What Is an Emergency Fund (and Why You Need One)

An emergency fund is a stash of money set aside for unexpected expenses.

Here’s why it matters:

- Avoid credit card debt

- Stay afloat during job loss

- Gain peace of mind

Experts recommend 3–6 months of living expenses, but starting small is okay.

🔵 Step 1: Set a Starter Goal

Don’t aim for $5,000 right away. Begin with a small, realistic target — like $500 or $1,000. Once you hit that, aim higher.

🔵 Step 2: Open a Separate Savings Account

Keep your emergency money in a different account so you won’t touch it. Look for:

- High-yield savings accounts (like Ally or Capital One)

- No monthly fees

- Easy access but not too easy

🔵 Step 3: Find Small Savings Opportunities

Even if you feel broke, there’s always something to cut:

- Skip 2 lattes per week = $20

- Cancel unused subscriptions = $30–$50/month

- Cook 3 extra meals at home = $50+/month

All that adds up faster than you think.

🔵 Step 4: Automate Your Savings

Set up an automatic weekly transfer — even just $10–$20/week. You won’t miss it, but it will grow quickly. Automation = discipline without thinking.

🔵 Step 5: Use Windfalls Wisely

Tax refund? Birthday cash? Freelance gig? Put at least 50% of any unexpected money into your emergency fund. It’s the fastest way to reach your goal.

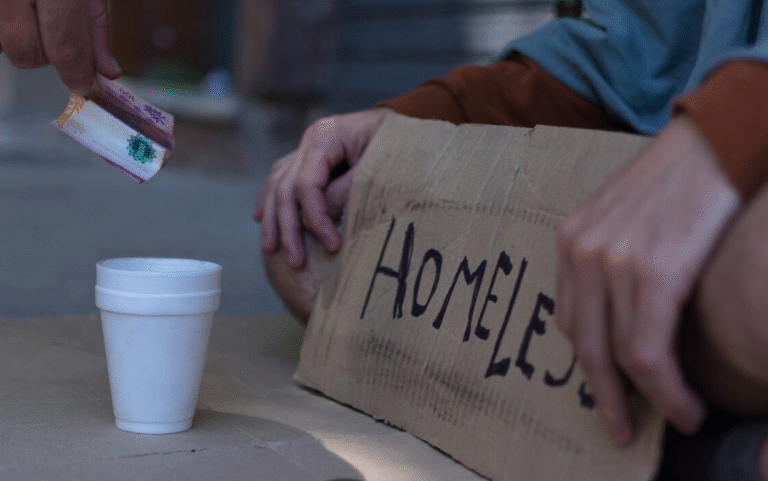

🔵 Step 6: Keep It for True Emergencies Only

It’s not for shopping, vacation, or upgrading your phone. Use it only when absolutely necessary — medical bills, urgent repairs, or income loss.

✅ Conclusion

You don’t need to wait for “the right time” to build your emergency fund — start today, even if it’s just $5. Every dollar is a step toward financial freedom and security.

📌 CTA:

Ready to start your safety net?

Open a savings account and save your first $10 this week. Small steps lead to big wins. 💪💵